REVOPS Partners Helps Small Businesses Secure Simple, Fast Equipment Financing so You Can Upgrade Before the Year-End Tax Window Closes.

About Section 179

Section 179 lets businesses deduct up to $1 million in equipment purchases made and placed in service before December 31. It's designed to encourage investment and growth, allowing you to write off the full purchase price of qualifying equipment in the year you buy it, rather than depreciating it over several years.

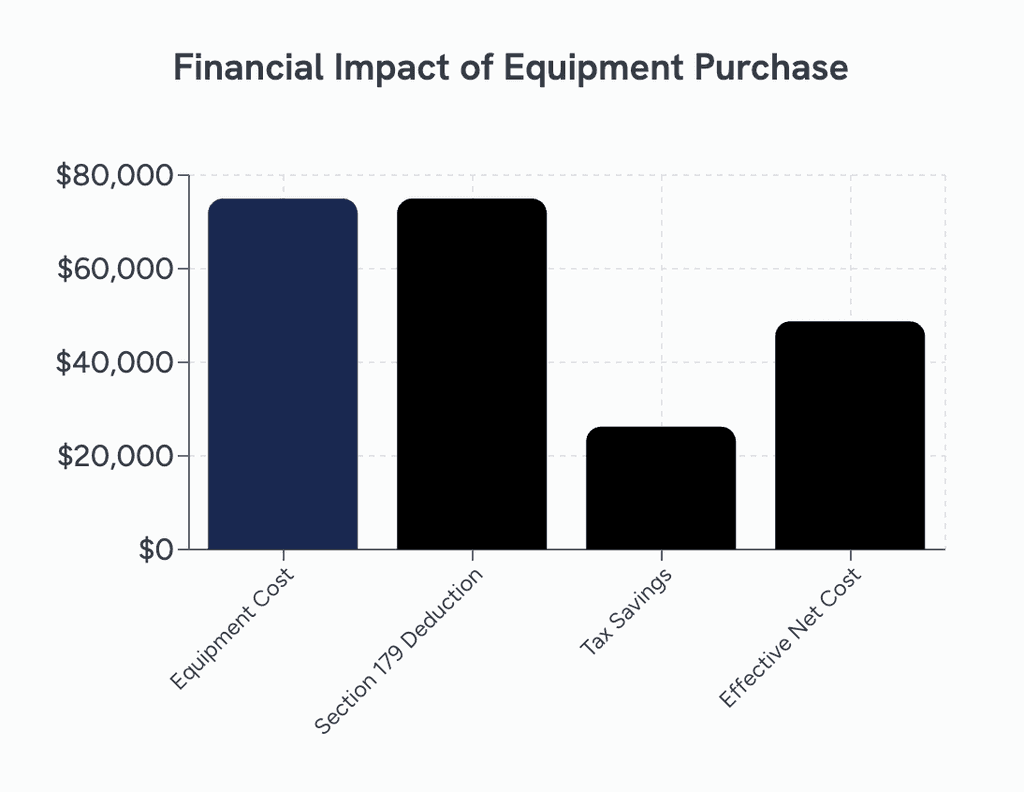

Example Calculation

Equipment Cost:

$75,000

Potential Section 179 Deduction:

$75,000 (subject to the overall $2,500,000 cap and eligibility)

Estimated Tax Savings:

$26,250 (assuming ~35% effective tax rate)

Effective Net Cost:

$48,750

This example demonstrates how Section 179 can instantly reduce your equipment costs and free up capital for other business priorities.

Why RevOps Partners

Time is Running Out!